New blog

My blog has now shifted to a Wordpress platform. Please visit it here.

My 12 hopeful predictions for 2012

We all do it at the start of the year, some more obstreperously than others (prediction #27: dictionaries will be eclipsed by "Google define"). So here's my top 12:

1 - Peace on earth

No, I've not recently read "How to win a pageant and influence people" nor have I any aspirations to win the Nobel Peace Prize (although, as I've always said, my greatest aspiration in life is to be quoted in a Nobel speech). I simply think that 2012 might be the year with the greatest likelihood to be the most peaceful in the history of mankind. Gone are (most of) the tyrants that started 2011 full of faith that they will see out another year "in office". While their removal, by their subjects or by God, may exacerbate conflict in their respective regions - imagine Kim Jong-un believing himself destined to conquer South Korea - I suspect these skirmishes will be restricted to the margin. The superpowers (read: China, Europe and the US) will have their domestic issues to deal with and would not want to get overextended abroad. Of course, international conflict, civil war and crime will continue to make headlines, but on a per capita basis - given the escalating global population - I predict that the world will be more peaceful place then ever before. (Which, incidentally, is what most "experts" apparently predicted at the start of 1914...)

2 - European fiscal integration

It is the only solution for Europe's continuing malaise and fortunately Europeans are beginning to realise this. There are serious constraints to further integration, of course, the most important of these is probably the difference in the way social security systems are financed between Germany, for example, and France. (In Germany, the current generation pay their own pensions; in France, future generations - who will be smaller in number - will pay for the current generation's pensions.) But these are trivial problems in the face of the alternative, a fragmented Europe, where each country resorts back to its own currency, imposing higher trade barriers and isolation. A federal model, based on the US system with some tweaks, offers the only positive outcome for a continent in crisis.

3 - Silicon Africa

Africa will increasingly become a hub for technology exports. Yes, while many parts of the dark continent are still, well, dark, the lights of technological innovation are being lit in the most unlikely of places. In the most immediate future (read: 2012), the attention will be on mobile technology. Kenya has taken the lead, but Nigeria and South Africa are fast catching up (and with their greater access to capital, will most likely purchase these start-ups, only to be dwarfed later by the Googles and Facebooks). Also expect some of the smallest and poorest African countries to join Silicon Africa, notably Uganda, Angola, Ghana, Ethiopia, Rwanda and Tanzania. This should not be surprising, as I've attempted to show in earlier research. The relatively high transport costs of containers and the relatively inexpensive communication costs (including internet access) will create a disincentive to export manufactured goods and allow African countries a comparative advantage in service exports. Travel services (tourism) is one area where this is already evident (although this sector is highly subject to stability and security; the terrorism attacks on the East coast can have serious consequences for tourism growth), but IT services will follow soon. Mobile is the first step in this movement, although we'll have to wait beyond 2012 to see second-generation applications emerging.

4 - Obama 2.0

Barack Obama will win a second term in office and begin to find the charisma that made him the hero of the free world in 2008. Perhaps he focused too much on issues that were less important to voters in the midst of a recession, but a (slowly) recovering economy will help him realign his priorities and push for "change". It will, of course, be helped by the fact that there is no serious Republican contender, an obvious consequence of the ideologically bankrupt sectarianism of the Republican Party. Once elected, Obama will push for a more integrated US economy (which might mean a greater focus to lower trade barriers, but we'll have to wait till 2013 for Doha), greater incentives for innovators and entrepreneurs, more investment in infrastructure, education reform and higher taxes.

5 - Building BRICS

The world's largest democracy is perpetually quashing domestic issues which leaves it little scope for contributions on the international stage. 2012 will see India becoming a more important stakeholder in international affairs, especially as mediator between the stagnant West and expanding East. Brazil will continue to grow on the back of high food demand (and higher food prices), especially from China. We'll also see more pessimistic predictions of the Brazilian FIFA World Cup and Rio Olympic Games. December protests in Russia will continue and become more severe; the 2014 Winter Olympic Games could suffer as a result. China will get new leadership, but don't bet against them religiously adhering to the blueprint of the previous. South Africa will realise that Nigeria is the more deserving African country to be included in this group of emerging economies; how about "On the BRINC" as the next business blockbuster?

6 - Oscillating ANC

Closer to home, expect statements from ANC officials and their alliance partners to become even more tumultuous than previous years. The stakes are high at the ANC policy conference in June and each stakeholder would want the upper hand as deliberations begin. This tumble drier policy would have little impact on what actually happens on the ground, both in terms of actual ANC fiscal and monetary policy (which will be dictated by Trevor Manuel and Pravin Gordhan, perhaps with some marginal tweaks to appease different factions) and private business (and the JSE), which will now have become used to political ramblings of all sorts. At the end of the year, it's a race between Jacob Zuma and Kgalema Motlanthe at the ANC elective conference in Manguang. The safe money is on wily Zuma, but don't be surprised if Motlanthe manages to bring together an eclectic assortment of vocal supporters. As a risky investor, I'd go for Motlanthe; he's in any case a better opponent to Helen Zille in a national election and probably a better president.

7 - Twitternami

Twitter will continue to grow as the pre-eminent social networking tool. Whereas Facebook is much larger and convenient for maintaining contact with long-lost friends and storing photos, Twitter is able to offer one thing that Facebook does not: it makes subscribers more, not less, productive. And in the Darwinian economy, it is greater productivity - and the tools that make it happen - that ultimately determine longevity. Twitter should become our main source of news (I heard about the 2011 Japanese tsunami first on Twitter before any online news network had a story about it; an hour later, I could broadcast it live to my students during a lecture), but also our first port of call for any discussions on topics we find interesting (for me, blog posts on economic history topics or reports from Arsenal scouts). Moreover, it is much easier to "network" through Twitter; when a friend, which opinion you value highly, passes on an interesting tweet, the person responsible for that tweet can be followed immediately by the click of a button. It's instant peer-review. Those with more followers are probably also those sending out interesting (and perhaps useful) tweets. And you can safely ignore those twits who rant on about their wife's cooking or their baby's first words. What better way to network or, as economists like to call it, build social capital? Have a business idea? Why not share it on Twitter with like-minded individuals who might suggest contacts, or even invest? It will be these linkages that will ensure Twitter's continuing success, and for some Twitteratis, those who've built up a large following, even fame and (perhaps) fortune.

8 - The beautiful game

Beauty will make a comeback in 2012. In troubled times, people will be satisfied with fewer goods, but demand beauty in the things they do buy. Apple brought us beauty in simplicity. 2012 will bring beauty in colour and curves. Socrates, the great Brazilian footballer who died last year, believed that beauty comes first, winning a distant second. As sport, and especially football, becomes the new global religion, Socrates will be proven right. Barcelona and Real Madrid's El Clasico brawls cost both teams fans; in 2012 they will be beautifully benevolent. Watch Holland to win the hearts of Europe, even if they again fail to win Euro 2012.

9 - Our children's loss

Environmental matters will take a back seat in 2012. Like HIV/Aids, our inability to act will leave a path of destruction evident to all, yet the topic will be considered "boring". Instead, we will refocus our attention on existing technologies, hoping to do more with less. Those that persevere with currently unprofitable (but innovative) ventures may win the most in the long-run. In South Africa, rhino poaching will continue, even as measures to protect these majestic animals increase. South Africans will want to continue blaming government unresponsiveness, greed or the Chinese. The only way to secure these animals sustainable existence is to legalise the trade in rhino horn. 2012 will not be the year when the rest of South Africa realise this.

10 - Going public

The popularity of public transport will continue to increase worldwide as a result of rising oil prices. More South Africans will also use public transport in 2012. Cape Town's MyCiti bus network will expand, connecting more Capetonians to the city. In Gauteng, the final Gautrain link to Park Station, Johannesburg will open, with a surge in demand for these rapid train services. Expect plans for expansion to be tabled. The integration of transport will also speed up the integration of racial division that is still prevalent in many of South Africa's urban areas. Hopefully, racial stereotyping will abate, with a greater focus on local issues and shared goals.

11 - Bookable

While the demise of the book will again be professed, more books will be written in 2012 than ever before. Hard copy book sales will also grow as people realise that not all books are better on the flat screen. Ironically, though, bookshops will continue to struggle. Expect online book retailers to do very well, especially those that compete on price. (I am a loyal supporter of loot.co.za but have recently been converted to bookdepository.co.uk which ships free anywhere in the world.)

12 - Class of 2011

Recent graduates will find it hard to get a job in 2012, and even more difficult to rapidly climb the corporate ladder. This will spur them to start their own thing. Starting a business in South Africa will be easier as red tape and tax regulations ease, and funding becomes more accessible. Expect local and foreign Angel investors to be on the look-out for the next innovative start-ups. The main constraint facing entrepreneurs may be weak demand, but there is always a market for a novel idea (according to Adrian Slywotzky and Karl Weber in their recent book "Demand: Creating What People Love Before They Know They Want It"). Recessions inevitably breed inventions and innovations, and 2012 may just be the year of the next big idea.

Bonus 13 - Let's have some fun

We will have more fun in 2012. Shorter, breakaway weekends to local destinations will be in fashion. Expect guest houses and small hotels in rural towns to do well. Rural retreats may also become fashionable, as workers attempt to get away from the office, which now follows you anywhere there is a mobile signal. Pipe smoking will be in fashion. The Extreme Ironing movement will make a comeback. Cultural festivals will be popular, as will mega-events; expect the London Olympics to be excellently organised and well attended. Now, if just one of the Proteas, Stormers or Arsenal can just deliver a trophy...

Let the games begin!

My December holiday book selection

I've made peace with the fact that I won't read all the books I buy. As Krugman showed, consumers love variety. I would argue that bibliophiles not only love reading lots of different books, but find utility in growing their bookshelf from a tweetsized temple to a monster mausoleum. (It is this utility that will keep printed books in business...) But sometimes I do get to read a little, and so I thought to share some of my recent reads here, in a very compacted format. I hope to do this every month, but that is perhaps too ambitious.

Adapt, by Tim Harford, is an easy-to-read account of trial-and-error in many different contexts. Not all projects succeed at first (and some never do), and Harford argues that this is a normal part of a capitalist society (mentality?). The most successful entrepreneurs/businesses/governments were those that experimented with different strategies/policies/techniques and learned from the many failures. The less successful ones were those that thought they knew the answer to their problem from the beginning and ostrich-like stuck to the outdated business model. These businesses go bust, and the reason they do is because they don't adapt. Bottom-up management - empowering those closest to the action - is what works, top-down management usually result in stagnation an decline. Individuals, too, should adapt by being open to criticism, recognising their past mistakes and learn from them. The book is littered with case studies of such adaptation. Perhaps some of these could have been shortened; the chapters on climate change and the financial meltdown seem very familiar. But the message is clear and correct: as with evolution, we must continuously adapt to our changing environment. Sometimes we get lucky early on, but if not, we should learn from our failures and try again.

Global Economic History: A Very Short Introduction, by Robert Allen provides an excellent overview of global economic change over the last 500 years. Allen is an expert on the Industrial Revolution, but this tiny book also showcases his authority on other, less popular histories, including the economic changes of Russia, Japan and the Americas. Allen excels at fusing economic theory and long data series into a narrative that would be understandable to any high-school student. Perhaps he should consider expanding this into a textbook for undergraduate students (as I've suggested to him, although he looked less than thrilled). I am more critical of his contribution on African economic history, as I've said before (see below). But this should not keep anyone from buying this as a Christmas gift for someone vaguely interested in economics, world history or those simply interested in understanding why some regions of the world prospered while others remained poor.

Grape, by Jeanne Viall, Wilmot James and Jakes Gerwel, offers an interesting perspective on the South African wine and table grape industry. The book is divided into eleven diverse chapters, including the origins of the wine industry, the demand for labour and its social consequences, South African wine consumption, the impact of climate change and land redistribution and transformation issues. A good blend. It is not an academic work, although it is firmly ingrained in the (historical and scientific) literature, except for a few minor errors (like spelling my name incorrectly). And although the narrative is sometimes coloured by a bias towards the disposessed and disadvantaged, it nevertheless is thought-provoking if not outright challenging. Next time you need to buy a gift for a visiting academic, buy her this rather than another Stellenbosch coffee-table book. Footnote: I've reviewed the book in Afrikaans (soon to be published on Litnet).

One small step for Manuel, one giant leap for Mzansi?

On 11/11/11, Trevor Manuel released the National Development Plan, South Africa's next growth target. The Plan aims to eliminate poverty and sharply reduce inequality by 2030. To do this, it has identified 9 key areas for improvement: creating jobs and livelihoods, expanding infrastructure, transitioning to a low-carbon economy, transforming urban and rural spaces, improving education and training, providing quality health care, building a capable state, fighting corruption and enhancing accountability and transforming society and uniting the nation. (The Plan is available here.)

It is difficult to fault any of these laudable goals. The Plan sets out numerous separate strategies to help achieve each of these goals. But let's focus only on what the Plan acknowledges as the most important of these - growth and job creation.

The Plan targets to reduce unemployment at 27 percent in 2011 to 14 percent in 2020 and 6 percent in 2030. To achieve this target, labour force participation must increase (by 11 percentage points), GDP growth must average 5.4 percent over the period, exports must increase by 6% until 2030 and the savings rate must increase from 15% to 25%. Oh yes, and most of this growth must be at the bottom of the distribution, as the proportion of income earned by the bottom 40 percent must increase from 6 to 10 percent. No lack of ambition here, given that we are struggling to achieve 4% growth at the moment.

Although the Commission had released a "Diagnostic Report" earlier in the year, this part of the NDP is in truth still very much diagnostic. It highlights the symptoms of the South African economic problem and then identifies their causes (but not yet offering remedies). This is the best part of the NDP. It correctly - in my opinion - identifies the severe constraints that hamper growth and development and, to its credit, addresses what must have been politically sensitive topics, such as mining property rights and labour regulation. It emphasises the lack of quality education and acknowledges that the public sector can and will contribute little to either growth or job creation.

The NDP, though, will be judged not on good diagnostics, but on its ability to achieve its targets (i.e. to dish out medicines - or surgery - where required). The Plan recommends numerous "actions". The 5.4 percent growth target, for example, requires that we "reduce the costs of doing business, gain global market share, broaden the public works programme, offer a tax subsidy for hiring young people, be open to immigration, simplify dismissal procedures, set up business incubators, address property rights in mining, procure locally, establish a single visa for SADC countries and address fragmentation in government", in short, "remove the most pressing constraints on growth".

Again, it is difficult to fault these solutions. Most economists, perhaps with a tweak here and there, would support such policy changes. But a more fundamental question looms: is high growth only attained when set out in a National Development Plan? Did those countries that experienced high and persistent growth do so because of a national development strategy, or was it that they were simply lucky - enjoying a comparative advantage in the right products at the right time? Certainly, there are examples of "planned" development: Japan and a number of other Asian miracles come to mind. But were these not also fortunate to implement the right policies in an environment conducive to growing exports? Only China and India has - over the last three years - sustained high growth rates even in the face of a global recession. Their size, though, allows them to escape the realities of shrinking foreign demand.

The National Development Plan sets out certain tasks to improve our business environment. That is commendable. Yet, it is not and cannot be a plan to grow at 5.4% (or at 8%, as the DA would want us to believe). Our ability to grow depends too much on open and growing international markets, international markets that are quite gloomy at the moment. India, China and (tiny) African markets may offer alternatives, but they will also procure locally and, more importantly, look to other markets to increase their exports. Rather than aim for the stars, South Africa should focus on microeconomic issues that allow entrepreneurs to do what they are good at: building their businesses. The NDP lists some of these reforms, and the government would do well to implement them. But whether we grow at 5, 8 or 11 percent depends more on the global economic environment - whether our entrepreneurs can find a market for their goods, locally or globally - and less on another moonstruck growth target.

The end of his story

Last night, I attended a guest lecture by Francis Fukuyama at UCT. Fukuyama is known for his book 'The End of History and the Last Man' but published the first of a two-volume 'The Origins of Political Order' this year, which was also the topic of his speech.

There is little doubt that Prof Fukuyama is an eloquent narrator. He compresses millennia of complex political change into an hour of spell-bounding story-telling. He is funny. He is charismatic. He is also intellectually gifted. His main thesis is that all institutions can be reduced to three variables: the power of the state, the rule of law and accountability. Definitions are important here. The power of the state refers to the executives ability to get things done. Rule of law refers only to those laws that is also applicable to the sovereign of the country. And accountability is a broader measure of democracy, refering to citizens ability to hold their government accountable. (He argues, for example, that many Eastern autocrats were also somewhat accountable because of the altruistic doctrine of Confusionism.) His stories match his theory perfectly; the difference between China autocracy and Indian democracy (or why China could build the Three Gorges Dam and India not a Nano manufacturing plant); the rise of an independent rule of law in Europe through the work of the Catholic Church, only then to be followed by an accountable government in England during the Glorious Revolution; why the American Civil War demonstrates that meritocracy rather than patriarchy works.

Yet, his final reflections on sub-Saharan African were perhaps the most interesting, and also the most unrefined. Africa was poor when Europeans arrived because of geography; sparse populations, no navigable rivers, etc. This resulted in weak states (no power), which was reinforced by colonialism's indirect rule. We still see these weak states today, with no accountability and little rule of law. His message? Europe took several centuries to build these institutions - which he argues is against our biological inclination to favour our kin. Why would Africa be any different, given that we inherit arbitrary borders and no notion of unity? In short: building institutions is bloody, and Africa has not shed enough blood.

I would have loved to ask him whether this is not too pessimistic. Perhaps there is a quicker way to "impose" institutions that reflect a strong state, rule of law and accountability. If so, I hope his second volume alludes to these solutions. If not, then certainly we are very far from the end of history.

African Cheetahs

I recently read Bob Allen's latest "Global Economic History". It's a great book, it takes less than a day to read (which is a huge plus) and it is inexpensive (R98), so there is no reason not to buy and read it. The book summarises what we know about the economic development of the various countries and continents across the world. I particularly enjoyed reading about the regions I know little about, like South American, Russian and Japanese economic development. For Africa, Allen explains not the episodes of progress, but attempts to explain why Africa is poor (and has always been so). This is a fashionable topic: a number of academic and popular books and papers have recently appeared attempting to identify the causal determinants of Africa's destitution.

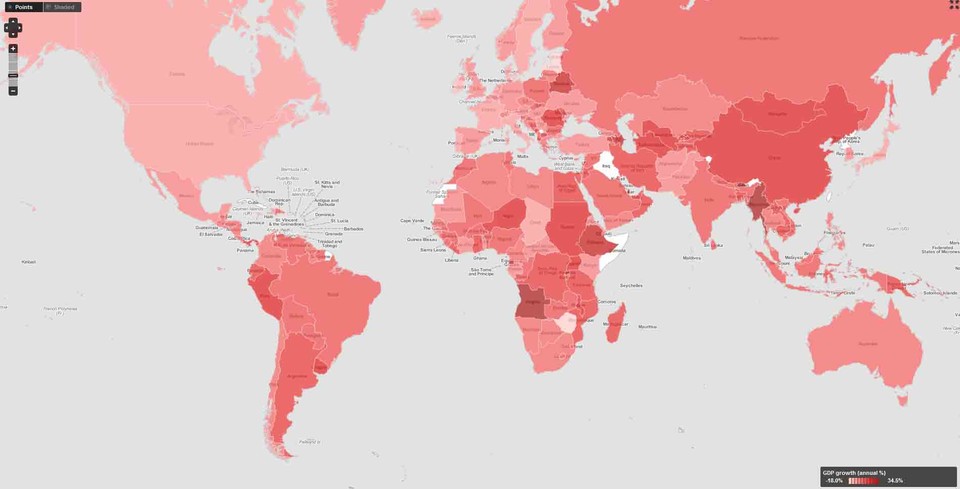

But perhaps we get the question wrong. Perhaps we should rather focus on African growth episodes, as Morten Jerven hinted at in a recent paper published in Economic History of Developing Regions. For most of our history, all countries have been poor. The exception is growing out of poverty, not remaining in poverty. There are a number of African countries that have achieved and maintained remarkably high growth rates; Jerven notes four case studies from history - Dahomey, Ghana, Zambia and Botswana. The map above (from the World Bank Development Indicators, 2006-2010) shows that we are missing another growth epidsode, this time relatively wide-spread across the continent (and during a global recession!). A large number of African countries are growing at historically unprecedented rates. Rather than searching for long-run factors that explain African poverty (which, let's face it, often have little policy implications), perhaps we should begin investigating the factors that propel some African countries - in the past and present - forward into high-growth equilibria. Why not a book about the emergence of the "African Cheetahs"?

Foreign experts

I did not get to attend the Discovery Investment Leadership Summit yesterday, but followed the highlights thanks to Twitter (#DILS11). There were a number of really famous speakers, including Graca Machel, Al Gore, Mario Ramos and Taddy Blecher (of which the latter should - in a perfect world - be the most famous).

And then there were two economists - Dan Ariely, a behavioural economist from Duke University, and Nouriel Roubini, Professor of Economics at NYU's Stern School of Business. From the tweets about Ariely's lecture, I wish I'd been at the summit. He seems to be entertaining and thought-provoking, and this YouTube clip should convince you of that. However, it is Roubini's speech that instilled on me how fallible we South Africans are for the thoughts of the foreign. Roubini's main message for South Africa, apart from that the world economy is going to get worse before it gets better (if it ever gets better), was this: "South Africa needs more infrastructural and educational investment to move from 3% growth this year to the desired 5-6%", according to a tweet by Dave Duarte.

Seriously? Did this man fly halfway around the world to tell South Africa's elite businesspeople that we need to invest in education and infrastructure? Well, yes, and it seems from the response on Twitter, the crowd loved him for it. The Engineering News has already published an article about his policy prescriptions (which Roubini himself has retweeted to his 86654 followers). Surely his remarks are based on pioneering research about South Africa's education and infrastructure challenges? Unfortunately but not unexpectedly, it's not.

Roubini is not an exceptional case, though. South Africa has a long history of attracting foreign policy experts to give advice about the route forward - think of Joseph Stiglitz relatively recent diliberations on inflation targeting, the Harvard team of the Mbeki era (who, it must be said, actually did do some groundbreaking research about the South African situation), or even Milner's Kindergarten, a group of young graduates who advised Lord Milner after the South African War at the turn of the twentieth century.

Any second-year student in my 281 class could tell you that South Africa's main economic constraints are education and infrastructure (perhaps we should add entrepreneurship, but that's another debate altogether). Not only do they know this, but government knows this, voters know this and, yes, even South African academic economists know this. What we are battling with is understanding how education matters and what to do about it. A good example of this is by our own team of education economists. Such research won't get you a one-liner at an expensive summit (and a headline in a newspaper), but it will offer more nuanced policy prescriptions that will begin to allevaite poverty and reduce inequality.

Let's hope that next year, Discovery will heed Roubini's call and invest not in importing experts with little to add to the South African debate, but in showcasing South Africa's own academic talent and research findings.

The long-run roots of South African inequality

The June issue of the journal Economic History of Developing Regions is dedicated to probably the most important issue in South Africa today: inequality. The papers trace the historical roots of South Africa's inequality problem. Dieter von Fintel and I contribute a paper on the Cape Colony, showing that, even amongst the farming population of the Dutch Cape Colony, severe income inequality persisted throughout the eighteenth century. Segments of the conclusion follow:

Using detailed records collected by the Dutch East India Company, we calculate new income inequality measures for the Cape Colony during the 18th century. We find that income inequality was severe and persistent throughout the period. Depending on various assumptions, the Cape Colony Gini ranged between 0.543 and 0.837, which is high relative to other countries for which measurements exist, during the pre-industrial period. The differences in mean incomes between slaves and Europeans only partially explain high levels of inequality. Notably, within-group inequality (particularly among farmers) plays an important role that cannot be accounted for in social tables often used in such studies.

Although the purpose of the current paper is not to verify or refute the Engerman-Sokoloff hypothesis in a larger context, it is tempting to suggest that the persistent high levels of inequality in the Cape Colony of the 18th century measured here may, to a certain extent, be a root cause of South Africa's high income inequality, and consequent underdevelopment today. Gini coefficients measured here are remarkably similar to those found in modern-day South Africa. Nevertheless,these estimates add to the evidence that their narrative can hold, even in a very specific context. This, to some extent, stands in contrast with other work that does not consider a full set of modern developing regions, and prompts a re-investigation of these matters. However, this first set of inequality estimates for a modern developing African economy may not be entirely comparable with other estimates for the rest of the world.

The estimates presented here are severe, either because the Cape really was one of the most unequal pre-industrial societies (among those for which measurements are currently available), or because the contribution of within-group inequality is ignored for lack of microdata in other regions. Should the former be true, it adds to the body of evidence that developing countries across the world (not just in samples for which estimates have been constructed up to now) potentially match the Engerman and Sokoloff hypothesis. While this contrasts with some evidence from Latin America (Williamson2009a), it begs the question whether all measurement issues are satisfactorily addressed using social tables. However, should the latter be a prominent issue, it is evident that some theoretical links between pre-industrial inequality and growth require renewed thought. More such histories with evidence, including calculations of within- and between-group inequality across different regions, will enable scholars to identify more accurately the mechanisms by which early inequality influences later development and underdevelopment. Furthermore, this research prompts the inclusion of a wider spectrum of cross-country pre-industrial inequality estimates to understand more fully the links with consequent development. In particular, excluded regions from the currently developing world would add significantly to the picture. While the Cape appears to have had among the highest levels of inequality in the pre-industrial era, it is quite likely that other colonies exhibited a similarly severe degree of inequality.

The papers are available here: http://www.tandfonline.com/toc/rehd20/26/1

South African sport mega-events

Danny Jordaan earlier this year questioned the lack of research on the impact of the FIFA World Cup 2010. This is about to change with the release of the latest Development Southern Africa, featuring a special edition on the impact of sport mega-events, specifically those in South Africa.

Krige Siebrits, Karly Spronk and I estimated the size of tourism displacement in two South African sport mega-events: the Indian Premier League tournament and the British and Irish Lions tour of 2009. We argue that the two tournaments present a natural experiment: whereas the Lions tour was already scheduled well in advance, the IPL shifted to South Africa only three weeks before the tournament was to commence in India.

Our findings suggest that some tourists from countries that did not participate in these events were displaced; the much stronger effect, however, was that tourists from the participating countries re-arranged their visits to coincide with an event. While confirming the inherent difficulty of measuring crowding-out effects, the paper show that characteristics of events can sometimes be exploited to obtain useful information on displacement from readily available data.

All the papers can be found here: http://www.tandfonline.com/toc/cdsa20/current. I hope Danny Jordaan takes note.

An Apartheid tax: the other side of the coin

It was not what the Desmond Tutu speech in Stellenbosch was about, but his mention of a wealth tax for whites to pay for the sins of the past has created a stir in the media. The idea of an Apartheid tax is certainly not new - prof Sampie Terreblanche claims to have called for one just after 1994 - and wealth taxes date back to long before income and value-added were even defined. (Even the first Cape settlers paid wealth taxes to the VOC; income taxes were only introduced somewhere in the late nineteenth century. South Africans, of course, still pay wealth taxes, in the form of property tax.)

The merits and demerits of a wealth tax can be found in any standard Public Economics textbook: they are often closer correlated with the ability-to-pay principle and thus improves the fairness of the tax system. They are also seen as a tool to reduce high levels of inequality in society. Wealth taxes are, however, not easily administered (everything you own must be impartially valued) and can lead to capital flight, brain drain and lower levels of investment (i.e. job creation).

Though the details of such a proposed tax are sketchy, there are two things that is clearly problematic with imposing an Apartheid tax now, seventeen years after the end of Apartheid. The first is that it will tax those individuals who've managed to, even given their constrained resources in 1994, work hard, invest in themselves and improve their level of wealth in the past seventeen years. Also, those individuals who managed to benefit from Apartheid but decided to leave South Africa after 1994 will not carry any burden. The dynamics of the top decile of South African society has simply changed too much for the incidence of an Apartheid tax to fall predominantly on the perpertrators.

Secondly, the debate has ignored the other side of the coin: what we will do with the money. It is a well-known fact that underspending is a serious dilemma for many a state department. Capacity constraints in government is the bottleneck in service delivery, not funding. And while the NHI might require a massive annual amount, it is not clear that a once-off wealth tax will provide a sustainable solution for this programme. Moreover, South African debt ratios is relative low compared to comparator countries; if we really needed funds, we could borrow.

An Apartheid tax may have been an option in 1995 or 1996, but it is not an option today. Those calling for it should rather look at ways to improve our capacity to deliver services - which will support our ability to sustain high levels of economic growth - as a solution for the severe South African inequality Tutu referred to.

Malemian development

Even though Mr. Malema probably doesn't know it, he is propagating what is known in development economics as a dependence theory. Saying things like "these publications replicate the apartheid ideology of white supremacy and portray black people as corrupt or superstitious human beings with no potential to develop and engage in conscious social, political and economic issues confronting SA" suggests that we need not look further than the colonial/Apartheid legacy to explain the underdevelopment of many black South Africans. Of course, the impact of colonialism and Apartheid cannot be denied, and the effects of racial segregation and economic disenfranchisement are still extremely visible 17 years after 1994.

Yet, Mr. Malema - and his neo-colonial dependence model - offers little alternatives to the market-oriented policies in solving the most serious of South Africa's economic problems, unemployment, poverty and inequality. He publicly expounds the virtues of nationalisation and land expropriation, but history is less optimistic about its benefits. What is clear from Mr. Malema's rhetoric is that the solutions to underdevelopment are not to be found internally - within poor, rural communities - but only from externally induced phenomenon, i.e. by government policies directed at the rich, not the poor. In fact, through his triumphant support of nationalisation and land expropriation, Mr. Malema suggests that the best thing that can happen to poor, black South Africans is for white South Africans to leave the country. (See also his recent reference to whites as "criminals".)

Of course, this is parallel to the age-old, Marxist, dependence model solution: revolutionary struggles are required to free dependent developing nations from the direct and indirect economic control of their developed-world oppressors. Or, in economics jargon, autarky. Mr. Malema's only alternative to the market-oriented system which he fights so vehemently against is a South Africa that is isolated from the international community, closed to international trade, and inward-looking. History - and in fact, very recent history - also has little optimism to offer proponents of such a policy design. Mr. Malema would do well to heed a fundamental truth paraphrased by Gary Fields: "If you're poor, you can't get rich by selling to yourself."

If we want to eradicate unemployment and poverty, we better debate, in the popular media (journalists!), pragmatic (read: market-friendly) solutions, rather than prophesizing hogwash uttered for the purpose of political support.

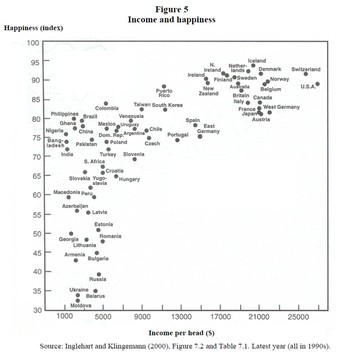

Communism and its discontents

In preparation for a new course on development theory, I came across this widely-cited empirical relationship between GDP and happiness. I've commented on happiness before, but what surprised me was the strong visual correlation between former communist countries (or countries part of the former Soviet Union) and low levels of happiness. We know that Russia's GDP, for example, was certainly not the worst performing between the 1930s-1970s (in fact, they performed better than many democratic, 'neoliberal' countries). But here it is clear that GDP is an insufficient measure of economic development: whereas production growth may have been impressive, the capability - to borrow Sen's phrase - of citizens to benefit from such growth was limited. I experienced this first-hand in 2009 on a trip to Finland, Estonia and Latvia. Whereas the Fins were a happy bunch (as is confirmed in the graph), the Estonians and Latvians seemed strangely gloomy and depressed. I don't remember once seeing a smiling face in any of those two countries. (The Fins, of course, vehemently fought Russian encroachment after the Revolution of 1917 - and successfully so - while communism spread through Estonia and Latvia.) Perhaps there is something to this happiness literature, with pertinent consequences for the road South Africa seems determined to tread.

Teach South Africa

Nearly a year ago, I wrote an Afrikaans column about an American education model I thought would be a great idea for South Africa. This morning as I get in the lift, I see a poster advertising a new movement – Teach South Africa – that goes one important step further: they actually put the idea into action. Find below the column I wrote a year ago. There is no doubt that quality education is the most important tool to alleviate poverty and combat severe inequality. This movement might be one small step for each of us but a giant leap for the future of our country. Find them at www.teachsouthafrica.org.

***

Onderrig vir Afrika

In die VSA kan studente wat hul studies voltooi het vir ‘n jaar of twee aansluit by ‘n organisasie genaamd Teach for America. Hierdie studente word dan verplaas na die armste gebiede om in die swakspresterende skole hul kennis as deeltydse onderwysers oor te dra. Hul verdien ‘n salaris wat met enige ander beginner-onderwyser sou kon meeding. En behalwe vir die oordra van feitekennis, moet die sosiale interaksie tussen middelklas-afgestudeerdes en lae-inkomste skoolkinders uit misdaadgeteisterde en gebroke huishoudings nie geringskat word nie.

Hoekom kan so ‘n stelsel in Suid-Afrika nie geimplementeer word nie? Suid-Afrika het sonder twyfel ‘n geweldige agterstand in kwaliteit-onderwysers. Skole in veral armer woonbuurte en provinsies sukkel met deurvloeikoerse en matrikulasie-slaagsyfers. Ja, dit is deels weens ‘n fisiese infrastruktuur tekort, insluitend geboue, handboeke, en skryfmateriaal. Dit is ook deels weens die leerplan wat take en ander skooldinge vir skoliere sonder toegang tot inligtingsbronne uiters bemoeilik. Maar, dit is ook weens ‘n tekort aan kundige, opgeleide onderwysers. Beslis is daar ervare onderwysers in hierdie skole wat jaar na jaar hard werk om skoliere voor te berei vir die uitdagings daar buite. Maar daar is te min van hulle. Heeltemal te min.

Natuurlik is nie alle afgestudeerde studente almal die perfekte onderwyser nie. Soos enigiemand wat sy eerste werk betree, gaan hulle foute maak. Hoewel mens sou kon argumenteer dat alle afgestudeerdes ‘n jaar na hulle studies gemeenskapsdiens sou moes doen (‘n verpligting, dus, soos die huidige twee “Zuma-jare” vir mediese student), sou dit eenvoudig ‘n logistiese nagmerrie wees. En duur. En ‘n politiese doodskoot omdat dit mense se vryheid van keuse vertroebel.

Maar dit kan werk as daar ‘n insentief is: ‘n salaris. In plaas van (of in samewerking met) loon-subsidies vir jong werkendes soos afgekondig in die onlangse begroting, sou die regering afgestudeerde student kon subsidieer om teen ‘n markverwante salaris vir ‘n jaar in ‘n arm skool klas te gee (veral in wiskunde en wetenskap). Die skoolhoof sou elke 3 maande kon terugvoer gee aan die provinsiale departement wat die student se prestasie monitor. Hierdie studente hoef nie die werk van huidige onderwysers oor te neem nie. (Ek sien al klaar die vakbonde wat hulle messe slyp.) Skoliere in die meer welgestelde skole kry juis ‘n voordeel omdat hulle toegang het tot ekstra klasse, ou vraestelle, en selfs net onderwysers wat hulle vrae deeglik kan beantwoord, of uit ‘n ander hoek verduidelik. (‘n Onlangse berig in die media toon dat sommige onderwysers nie die antwoorde op matriekvraestelle ken nie.) Nie net hou hierdie klasse voordele in vir die skoliere nie, maar ‘n jaar in ‘n arm woonbuurt sal vir baie studente ‘n oogoopmaker wees na die werklike probleme in ons samelewing. Ek sou selfs glo dit sou tot rasse-, kultuur- en geloofs-interpatie lei, waar ons mekaar beter leer verstaan deur jou in die skoene van die ander persoon te plaas.

En die regering hoef natuurlik nie die hele loon te dek nie; hierdie is ‘n ideale geleentheid vir maatskappye om ‘n konstruktiewe bydrae te maak tot die opheffing van die gemeenskap. Hulle sou byvoorbeeld studente vir die maatskappy kon werf, maar daarop aandring dat die studente in hul eerste jaar aan hierdie program deelneem.

Dit is natuurlik iets wat landswyd nodig is. Maar dit sou selfs net provinsie-spesifiek kon wees: Verbeel jou watter verskil 500 UK-, UWK- en US-afgestudeerdes in die 50 swakspresterende Wes-Kaapse skole sou kon maak? Dis waar dit begin: Teach for the Cape. Dan Teach for South Africa. En wie weet, miskien eendag sal ons kinders se kinders (wat trou is) vra, so waarheen gaan jy vir Teach for Africa?

The last class

I took responsibility for a new second-year course during the first semester on economic development in the long-run (i.e. economic history). Friday was the final class for the semester and I wanted to end with a few 'lessons from history for development'. It turned out to be more difficult than I had anticipated; both history and development is far too complex to bundle into three or five specific 'lessons to be learned' and I inevitably generalised into The Book of Truisms - "The only constant is change", "Development is path dependent", "Getting rich is expensive". So much for 4 months of lectures.

But even though these 'lessons' might be self-evident, I think we all too often forget to appreciate their ubiquity. I often fail to realise that ours is probably the first (perhaps second) generation in South Africa where the optimists believe that our children will live in a better world than we do. (There will always be pessimists - it is the nature of the human beast. Best is to ignore them; as Landes notes, pessimism can only offer the empty consolation of being right.) While change has always been with us, it occurred at a much slower pace and, for most of human history, mostly took a turn for the worse (before it turned into someone else's advantage). Except these days. New technologies allow us to think completely differently about what to consume (what is your source of news today? Is it the same source as in 2000? It probably is not the same source of 2020), what to study (will Accounting allow me to take advantage of the rapid innovations in society, or is Physics, Philosphy or Industrial Engineering not a better option?), what to choose as a career (most people do not work in the field that they studied - which is a good thing if I look at second-year essays), where to invest (the most profitable industry in two decades probably does not exist today) - in short, how to acquire wealth sustainably. The most successful people (regions, societies) will be those that adapt to change the best, those where tradition and command play less of a role and where innovation, entrepreneurship and ingenuity are traits that are cherished.

Which is not to say that everyone, everywhere is able to take advantage of the rapid changes that society will face over the next few years. If South Africans are exceptional in any way, it is because they understand that the past, even the distant past, determines your prosperity today. Whether you are born into the northern suburbs of Cape Town or the rural heartland of the former Transkei still largely dictates your success in life, much more than your innate ability, skill or ambition. History matters. Yet it is not deterministic. It need not matter. It ought not matter. And, ironically, its history (again) that points us in the right direction, that show us how to overcome the conditions that perpetuate poverty, encumber the unemployed and preserve the high levels of inequality that permeate South Africa society. We can borrow lessons from other regions, but we need not look further than our own experiences with eradicating poverty.

In all these 'success stories', though, one lesson remains unopposed: no-one get's rich cheaply. Sacrifice is the catalyst that drives progress. We cannot live beyond our means and expect that our children will be able to do the same. Someone must pay - in taxes, or leisure time, or - worse - in lower living standards. Often, the choice is not ours to make. The working class of the Industrial Revolution had little choice in their low wages and poor conditions. But these allowed the factory owners to further invest in new technologies, increasing productivity and - eventually - improving life for all. Chinese workers at this exact moment are beginning to see returns on their "investment" over the last three decades. Whites in South Africa, of course, profited from the low wages of black workers before and during Apartheid, although the story has changed considerably since the 1980s. The relatively high wages paid to workers over the last three decades have prevented South African entrepreneurs (who could have been black) from building productive enterprises (which would have eventually increased wages), but worse, it has excluded 40% of South Africans who would have desired to become part of the formal economy, but has now been left on the periphery, perpetuating the high inequality. (Remember, wage workers in South Africa are in the top 40% of the South African income distribution, COSATU members are in the top 20%.) Had we only sacrificed the marginally higher wages of the working class during the last three decades, we might have been able - like democratic India - to enjoy economic growth of between 6 and 10% annually. There is no way to solve poverty (and unemployment, and low wages) faster than through economic growth.

But the past is past. What to do now? The inequality of opportunity brought about by our history is still the nexus of South Africa's current policy debates, the ANCYL's call for nationalisation the most extreme and radical intervention. Too many South Africans feel they have profited little from democratic freedom. Most have, but they compare their incomes to those at the top and remain unhappy. The sacrifices of the past have not resulted in prosperity for the children of the sufferers.

Fortunately, there is a way out, albeit a difficult one. At a Cape Town conference during the World Cup, a UCT geographer asked the following question: How do you win the World Cup? Do you appoint an experienced Brazilian coach at high cost? Or do you give every kid in South Africa a soccer ball? Technology allows us to leapfrog many of the constraints of the traditional trickle-down. It allows us to circumvent the extreme sacrifices that are associated with the industrial revolution. It builds human capital faster, leads to denser and shorter networks and connects us to a globalised (flat) world. It is not a quick answer. (We will not win the World Cup in 2014 or 2018 and maybe not in 2022. But maybe.) But there is no quick answer. (For all his experience, the Brazilian coach made little difference.) We need a society where the incentives are geared toward improving productivity through education, innovation and ingenuity, where our history matters less than our ability to take advantage from the opportunities given to us, and where the sacrifices we make today translate into benefits for us and for our children.

On mega-histories and predictions

Two significant contributions to the mega-history debate have recently been published - Why the West Rules - for Now (by Ian Morris) and Civilization (by Niall Ferguson). Morris's contribution builds on Jared Diamond's Guns, Germs and Steel to argue that the reason the West ruled was mostly due to geography and, importantly, how societies adapt to the changing climate and environment. Ferguson argues that Europe developed six 'killer apps' that ensured that they ruled the world after 1411. Both authors paint pessimistic pictures for future Western domination.

I don't want to comment too much on the content of the books; there is certainly a lot of fascinating reading for anyone interested in history. What is more interesting is the way historians are adapting their profession to say something about which all of us know even less: the future. Economists often get heavily criticised for projecting or forecasting trends two, three years or even a decade into the future. Much of the criticism is true; the world is such a complex being that by projecting what will happen even a few months down the line, economists risk looking like fools. And ask any investor, we often do. Enter historians. Using mega-histories to explain the rise and fall of societies which, incidentally, is subject to a lot of criticism from within the History profession, they claim to be able to see far into the future. Of course, as with all predictions, they might be wrong. And, in truth, they almost certainly will be. But that isn't the point.

What matters is that no-one in 50 years will remember their predictions. And because of this lack of accountability, they will not suffer ridicule or budget cuts. Economists could learn a lot from historians. Science probably less.

On hope, optimism and happiness

A tough day of teaching. This morning, a class about the Golden Age of world growth, and its inevitable end in the stagflation of the 1970s. I suspect the only thing the class remembers is a joke about a picture of a smiling woman in the typical American kitchen of the 1950s. I said something about chains and Photoshop. (The picture illustrates the sudden availability of all kinds of kitchen utensils, including dishwashers and washing machines. These technologies allowed women to enter the labour market, further boosting growth - but also unemployment.)

For lunch we had John Knight of Oxford explaining the paradox of Chinese growth without happiness. I am not so sure a measure of happiness can describe economic change accurately or have any meaningful policy implications. Should we leave the poor in rural areas simply because they are happy; or should we attract them to the cities with promises - "aspirations" - of jobs and big money, only to leave them unfulfilled with unhappy - but longer - lives?

As in the Chinese case, even though the migrant workers are worse off, they don't return to the happy, rural areas. I wonder why? Surely it cannot be because of high transport costs only. I suspect it is because they realise - and hope - that their children will be better off in the cities. That even though their aspirations have not been met, the central aspiration that drove millions of people over millennia - to see their children live in a better world than they did - also drive them to stay in the cities and hope for the best. Unhappy but hopeful lives perhaps trump happy but ignorant ones.

This afternoon I lectured on the role of trade, tourism, infrastructure and the 2010 FIFA World Cup in South Africa. Quite a mouthful for two hours to a group of international students. It's rather fascinating to observe the differences between the American and European students. The first group is much more optimistic about life - and South Africa - while the second seems to perpetually criticise and complain. As David Landes once put it: "In this world, the optimists have it, not because they are always right, but because they are positive. Even when wrong, they are positive, and that is the way of achievement, correction, improvement and success." Perhaps optimism helps explain comparative economic performance. And happiness - the kind that is reflected by a smiling American woman in her kitchen - is only a long-run spin-off.

Other lessons

With reference to Mr Manuel and Mr Manyi's debate, I found this poignant quote from a speech made in 1934 by a certain Stellenbosch sociology professor justifying affirmative action in response to the poor-white problem: "There is valid reason for such temporary discrimination in some circumstances, as it will be in the interest of the country. However, this is the only way to sympathetically account for the welfare of both the Whites and non-Whites, even if it does carry with it the resemblance of prejudice."

It's important to remember that in economic policy, as in life, two negatives does not make a positive. Mr Manuel's defense of the Constitution is much applauded, but he would do well to also remember other lessons from the past.

*The quote is from a speech by HF Verwoerd cited in Joubert, D. (1972), Toe Witmense Arm Was: Uit die Carnegie-verslag, 1932, Tafelberg, Cape Town, p56.

Mega-sport events and tourism

In expectation of the FIFA World Cup hosted in South Africa last year, Maria Santana-Gallego and I looked at the marginal impact of past mega-events on tourist arrivals using a standard trade gravity equation (but now with tourism as our dependent variable, not trade flows). The paper is now published and can be read here. A brief summary follows:

While a mega-sport event is scheduled at least once every year somewhere in the world, these events are rare occurrences for the host cities and countries. The benefits of such events seem lucrative; the very fact that many countries bid to host these events suggests that the benefits – be they tangible or intangible – more often than not outweigh the costs. Using a standard gravity model of bilateral tourism flows between 200 countries from 1995 to 2006, this paper measures a very direct benefit of such mega-events: the increase in tourist arrivals to the host country. In general, the results suggest that mega-sport events promote tourism but the gain varies depending on the type of mega-event, the participating countries and whether the event is held during the peak season or off-season.

A big thanks to Andrew K. Rose for allowing us to use his data. I was also hugely impressed with the speed and service received from Tourism Management. Even though one of the three referees responded slowly, they apologized for his late response (after about six months) and once the paper was accepted, it took less than a month for it to go through the usual editing and publishing stages. Economics journals can learn a lot.

The ultimate cause of prosperity

Teaching always helps to structure one's thoughts. Yesterday I taught a session on the roots of the Industrial Revolution which will be followed by a second session today on its implications for economics. There is no doubt that England of the late eighteenth century witnessed one of the most remarkable transformations of any society in any period of history (which is also why, incidentally, the eighteenth century is my favourite century). So what can we learn from this most profound period?

Ultimately, it's all about productivity. Increasing (and improving) outputs with fewer and fewer inputs. This is either through labour productivity (where output increases because labour performs better, i.e. is more productive) or total factor productivity (where output increases without necessarily improving any of the inputs). And what drives productivity? Investment. Not only financial investment - saving your non-consumed budget in a bank - but also direct investment in capital goods that augment labour's productivity. Like buying any household appliance - a dishwasher! - that will save you time spent on consumption.

Saving drives investment. Again, not only financial saving in the sense of not spending your entire budget. But also saving in terms of not spending all your leisure time leisured. During the Industrial Revolution (and during most countries phase of rapid economic development), society as a whole - willingly or unwillingly - chose not to consume their maximum alloted goods or leisure, and saved their money (as investment) or time (as extra work) in producing capital goods. Through the incremental improvements in capital goods that followed (facilitated by institutions that encourage innovation), we are all able to live far better and fuller lives today than our ancestors 300 years ago.

What are the lessons for South Africa today? Our savings rate is embarrassingly low. We seem to be all too focused on consuming even beyond our abilities (helped by Reserve Bank interest rates that discourage saving). We can do this because the rest of the world, notably countries in the East, is happy to save at high levels and invest abroad. But we should not be surprised if, in the near future, our competitiveness is further eroded by our inability to do the most fundamental of activities that drive economic prosperity. To become more productive - and thus prosperous - we need to save and invest our time and money.

First thoughts

The reason I do what I do: "The deep inequality between Black and White, and the widening gulf between rich and poor in South Africa have roots which go deeply into our past. Whilst that history cannot be undone it has to be recognized and understood if we are to devise effective strategies to overcome it. In doing so we need to recognize also that the extractive (rather than sustainable) philosophy which has infused almost all forms of economic activity since Europe first returned to Southern Africa in the seventeenth century now has to change radically. The long-term consequences of cutting timber without regenerating the trees, farming without care for the soil, mining without care for the water, smelting without care for the atmosphere, growing the economy without care for the unemployed and governing without due care for the quality of education of all our children are becoming all too apparent. Fundamental rethinking is needed to re-shape South Africa's path into the twenty-first century." ~ Francis Wilson. Read the full article in the upcoming issue of Economic History of Developing Regions.

Login

(for staff & registered students)

BER Weekly

23 Jan 2026 Free Weekly Review | Number 3 | 23 January 2026This report covers the key domestic and international data releases over the past week....

Read the full issue

BER Weekly

23 Jan 2026 Free Weekly Review | Number 3 | 23 January 2026This report covers the key domestic and international data releases over the past week....

Read the full issue

The Department

The Department